Nike’s stock performance has been under scrutiny as it has dropped 38% in the past twelve months, trading at its lowest level since 2018. This decline has resulted in the company underperforming the S&P 500 by approximately 16% this year.

The upcoming fiscal Q4 earnings report, scheduled for June 26, is a critical moment for investors. It will provide clarity on whether Nike can reverse its downward trajectory. The earnings release will be crucial in understanding the company’s current state and future outlook.

Analyzing Nike’s stock and financial metrics will help investors make informed decisions. The athletic footwear giant faces a challenging period as it navigates changing consumer preferences and implements strategic initiatives to restore growth.

Key Takeaways

- Nike’s stock has significantly declined over the past year.

- The Q4 earnings report is crucial for understanding Nike’s future outlook.

- Investors are seeking clarity on Nike’s ability to reverse its downward trend.

- Nike faces challenges in navigating changing consumer preferences.

- The company’s strategic initiatives aim to restore growth and market performance.

Current State of Nike Stock

Nike’s stock has experienced a significant drop, sparking concerns about the company’s long-term growth trajectory. Despite beating expectations in its previous earnings report, the company’s shares have dropped another 17%. This decline highlights deeper concerns about Nike’s future prospects.

Recent Stock Performance

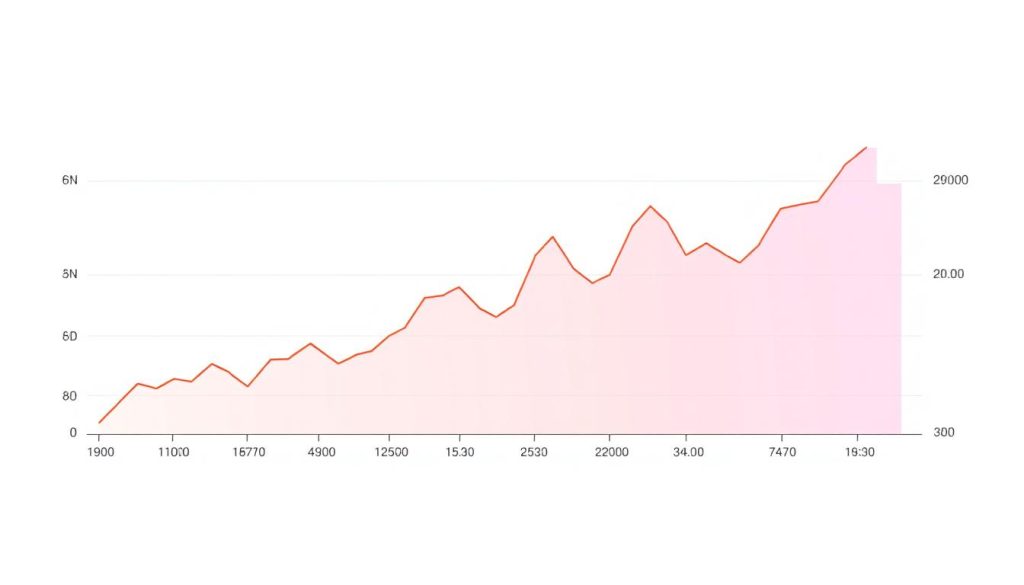

Nike’s stock performance has been lackluster, with the company posting four consecutive quarters of negative growth. In Q3 2024, revenue dropped 9%, marking a significant decline. The stock has significantly underperformed compared to the broader S&P500 index, raising questions about its competitive position in the athletic footwear and apparel market.

Key Financial Metrics

Nike’s key financial metrics reveal a company in transition. Earnings per share (EPS) fell 30% year-over-year, forcing investors to reassess Nike’s premium valuation relative to its growth prospects. The company’s net income collapsed 32% year-over-year, while revenue dropped 9%. Despite these challenges, Nike maintains a free cash flow yield of 5.7%, exceeding the U.S. 10-year Treasury yield.

| Financial Metric | Q3 2024 | Year-over-Year Change |

|---|---|---|

| Revenue | $9 billion | -9% |

| Net Income | $1.2 billion | -32% |

| Earnings Per Share (EPS) | $0.8 | -30% |

The current quarter results will be crucial in determining whether Nike can stabilize its financial performance and begin rebuilding investor confidence in its business model and market position.

Factors Driving Nike Stock’s Decline

Several key factors are driving the decline in Nike’s stock value. The company is facing significant challenges across various fronts, impacting its overall market performance.

Shift in Consumer Preferences

A fundamental shift in consumer preferences is occurring, with younger shoppers increasingly favoring smaller, niche athletic brands over traditional giants like Nike. This trend is creating significant headwinds for Nike’s market share. The rise of brands like On, Hoka, and Lululemon has altered the competitive landscape in the apparel market.

Challenges in the Chinese Market

Nike’s challenges in the Chinese market represent a major reversal from previous years when China was a primary growth engine. Local competitors are gaining ground, and geopolitical tensions are complicating Nike’s position. Weak consumer spending in China is further exacerbating the issue, contributing to the decline in Nike’s earnings.

Direct-to-Consumer Strategy Issues

Nike’s ambitious Direct-to-Consumer (DTC) strategy has resulted in unexpected complications, including higher logistics costs and customer acquisition expenses. This shift has negatively impacted Nike’s earnings and operational efficiency. The lack of meaningful product innovation has further strained the company’s ability to compete effectively in the market.

| Challenge | Impact on Nike | Market Trend |

|---|---|---|

| Shift in Consumer Preferences | Loss of market share | Rise of niche brands |

| Challenges in Chinese Market | Decline in earnings | Increased local competition |

| DTC Strategy Issues | Higher logistics costs | Increased operational complexity |

The combination of these challenges has contributed to Nike stock’s underperformance relative to both the S&P500 and its direct competitors. Analysts view these issues as systemic rather than temporary, suggesting that Nike needs fundamental strategic shifts to reverse the negative trend in its stock performance and regain its leadership in the apparel market.

Upcoming Nike Earnings Call: What to Expect

Nike’s upcoming earnings call on June 26 will be a critical test for the company’s leadership. Investors are keenly focused on the company’s ability to navigate current headwinds and demonstrate progress in its turnaround efforts.

Projected Revenue and EPS Estimates

Wall Street analysts are projecting EPS of $0.12 and revenue of $10.7 billion for Nike’s Q4 earnings. The company’s guidance indicates a continued decline in revenues, with a mid-teens percentage drop expected. Investors will be watching closely to see if Nike meets or exceeds these modest expectations.

Inventory Management Progress

Nike’s management has been working to reduce excess inventory that previously led to heavy discounting and margin compression. The company’s efforts to manage inventory levels will be under scrutiny, with investors seeking signs of progress in this area.

Cost-Cutting Initiatives

Nike has announced plans to cut $2 billion in costs over the next three years. Investors will be looking for updates on the implementation of this cost-cutting initiative and its expected impact on future earnings. Any signs of progress in this area could help boost investor confidence in the company’s long-term growth prospects.

The earnings call represents a critical opportunity for Nike’s management to demonstrate progress in their turnaround strategy and rebuild investor confidence in the company’s ability to navigate a challenging market environment.

Future Outlook for Nike Stock Investors

As Nike navigates its current challenges, the future outlook for investors remains a topic of significant interest. Despite the company’s recent struggles, several factors suggest potential for long-term growth and investment value.

Nike’s valuation metrics indicate that the stock is trading at 15x cash flows, which is below traditional peers like Adidas and significantly lower than newer competitors such as On Holdings. This disparity presents a potential opportunity for long-term investors who are willing to weather current challenges.

Under the leadership of CEO Elliot Hill, Nike is implementing strategic initiatives aimed at rebuilding wholesale partnerships and driving innovation through tech-driven product launches slated for 2025. The company’s ambitious cost-cutting target of $2 billion over the next three years is also expected to improve profitability.

Investors should closely monitor Nike’s ability to adapt to changing consumer preferences and competitive challenges in the athletic apparel market. The upcoming quarter’s earnings results will provide crucial insights into whether Nike can stabilize its business and begin rebuilding momentum for future growth.

While challenges persist, Nike’s strong brand equity and global reach position it for potential long-term success. As the company works to regain its market leadership position and improve shareholder value, investors may find Nike stock to be an attractive option for those looking for a potentially undervalued investment opportunity in the market.